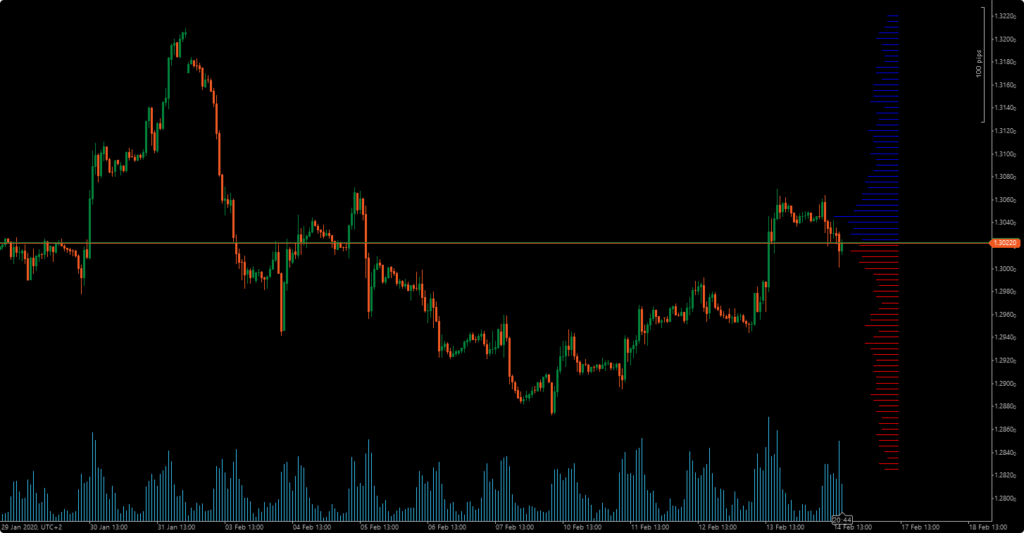

This indicator uses the Oanda’s OrderBook API to draw a set of horizontal lines, each one representing the number of trapped open positions at a given price. More specifically, above the current price it shows the open buy orders and below the current price it shows the open sell orders.

Input Parameters

- Height: indicates how many pips above and below the current price it should draw.

- Width: represents the scale of the drawn lines.

- Token: this is a token string required to use Oanda’s API. To get one, you must register for either a free demo or a live account. More info at https://developer.oanda.com/rest-live-v20/introduction/

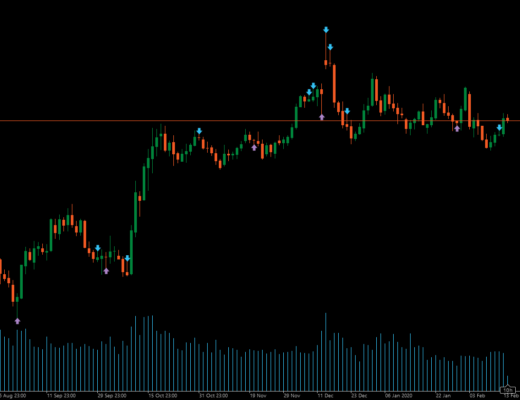

Screenshots

Code

using System;

using System.Net;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

using Newtonsoft.Json.Linq;

using System.Collections.Generic;

using System.Globalization;

using System.IO;

using System.IO.Compression;

using System.Text;

namespace cAlgo

{

[Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.Internet)]

public class OandaOrderBook : Indicator

{

[Parameter(DefaultValue = 200)]

public int Height { get; set; }

[Parameter(DefaultValue = 30)]

public int Width { get; set; }

[Parameter(DefaultValue = "")]

public string Token { get; set; }

private static string apiurl = "https://api-fxpractice.oanda.com/v3/instruments/";

private int line_index = 0;

//private DateTime orderbook_dt;

protected override void Initialize()

{

LoadOrderBook();

}

private void LoadOrderBook()

{

using (WebClient webClient = new WebClient())

{

webClient.Headers.Add("Content-Type", "application/json");

webClient.Headers.Add("Authorization", "Bearer " + Token);

webClient.Headers.Add("Accept-Encoding", "gzip");

byte[] data = webClient.DownloadData(apiurl + Symbol.Name.Insert(3, "_") + "/positionBook");

using (var compressedStream = new MemoryStream(data))

using (var unzipStream = new GZipStream(compressedStream, CompressionMode.Decompress))

using (var resultStream = new MemoryStream())

{

unzipStream.CopyTo(resultStream);

var json = JObject.Parse(Encoding.ASCII.GetString(resultStream.ToArray()));

DrawOrderBook(json);

}

}

}

private void DrawOrderBook(JObject json)

{

int index = Bars.OpenTimes.GetIndexByTime(Bars.OpenTimes.LastValue) + 20;

double refprice = double.Parse(json["positionBook"]["price"].ToString().Replace(".", ","));

var buckets = json["positionBook"]["buckets"];

foreach (var bucket in buckets)

{

double price = double.Parse(bucket["price"].ToString().Replace(".", ","));

double count = Width * double.Parse(bucket[price > refprice ? "longCountPercent" : "shortCountPercent"].ToString().Replace(".", ","));

if (Math.Abs(price - refprice) / Symbol.PipSize < Height)

{

int startindex = index - (int)Math.Floor(count);

Chart.DrawTrendLine("bucket" + line_index++, startindex, price, index, price, price > refprice ? Color.Blue : Color.Red, 1);

}

}

}

public override void Calculate(int index)

{

}

}

}